carried interest tax uk

Carried interest now falls into one of two categories. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains.

Pwc Cn Publication Carried Interest Tax Concession Draft Guideline On Certification Of Funds By The Hkma

Tax Practical Law UK Practice Note 6-596-5847 Approx.

. Carried interest is a term used to describe the slice typically 20 of super profit profit in excess of a hurdle generated on alternative investment funds which is payable to the. Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits. 3 Taxation of carried interest in the UK 23 By James McCredie and Alicia Thomas Macfarlanes LLP The underlying rules partnership taxation 26.

These funds invest in a wide range of assets including real estate. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be charged.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to. In principle annual fees have been subject to income tax but carried interest. I was doing some research on the tax treatment in the UK and from what I understand carried interest is considered as capital gains 20 tax rate.

See recent article on UK Budget 2021 The rules on the tax treatment of carried interest are complex. On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower rate of tax. In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate of tax on.

An investment manager generally receives fees linked to the value of assets under management. Current tax treatment of carried. Private equity executives receiving carried interest could be in for a significant tax hike after the UK announced an investigation into the countrys capital gains tax system.

Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax. Current law on the taxation of carried interest within sections 103KA to 103KH Taxation of Chargeable Gains Act TCGA 1992 was introduced by section 43 of. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is.

However it looks like there are many. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property If a user pays basic rate tax they will pay Capital Gains Tax on carried. The introduction of the Disguised Investment Management Fees.

Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they. The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has. And that planning.

30 pages Ask a question Carried interest.

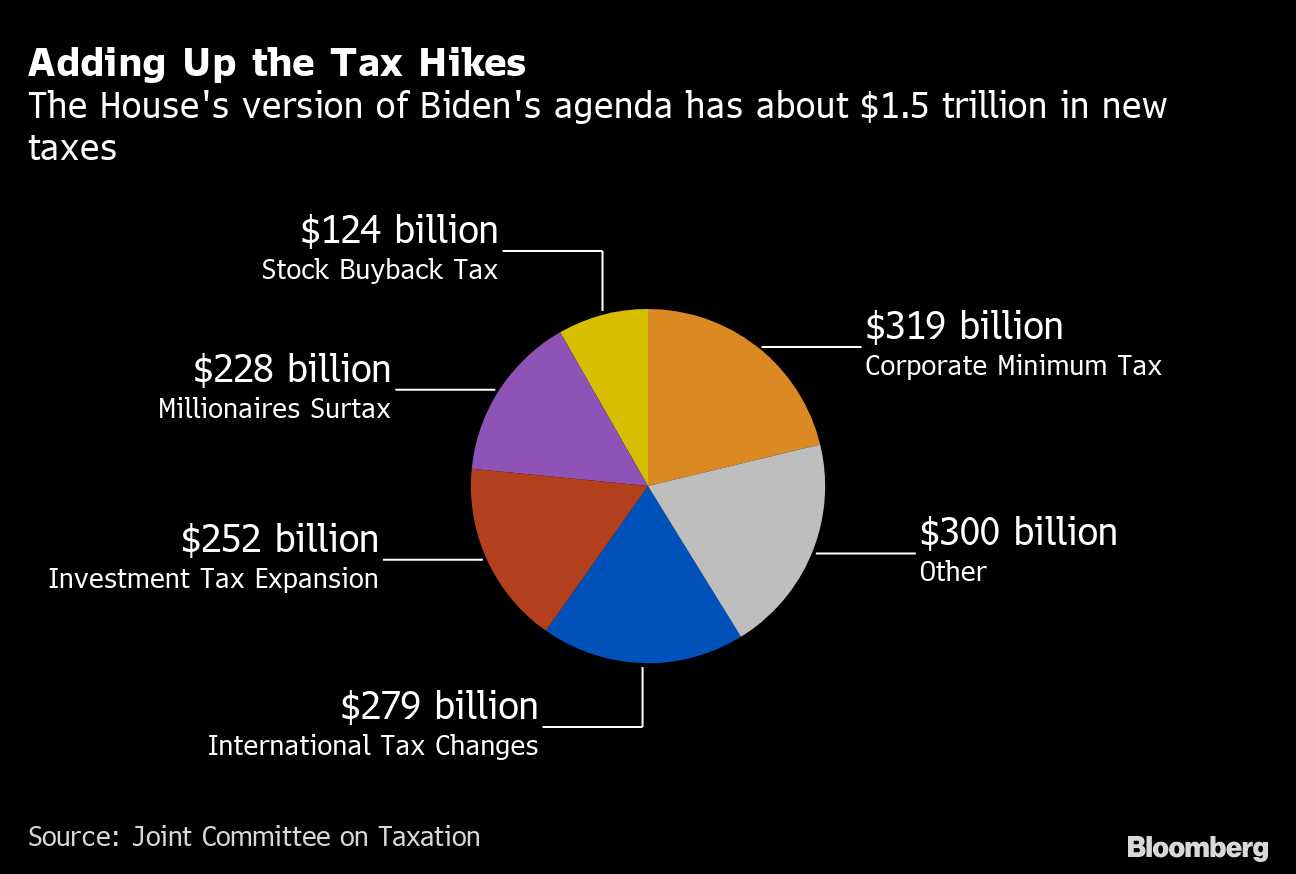

Rich Wall Streeters Face Shock Tax Hike Thanks To Manchin Schumer Deal Bloomberg

Ns I Change To Interest Payments May Double My Tax Bill Bonds The Guardian

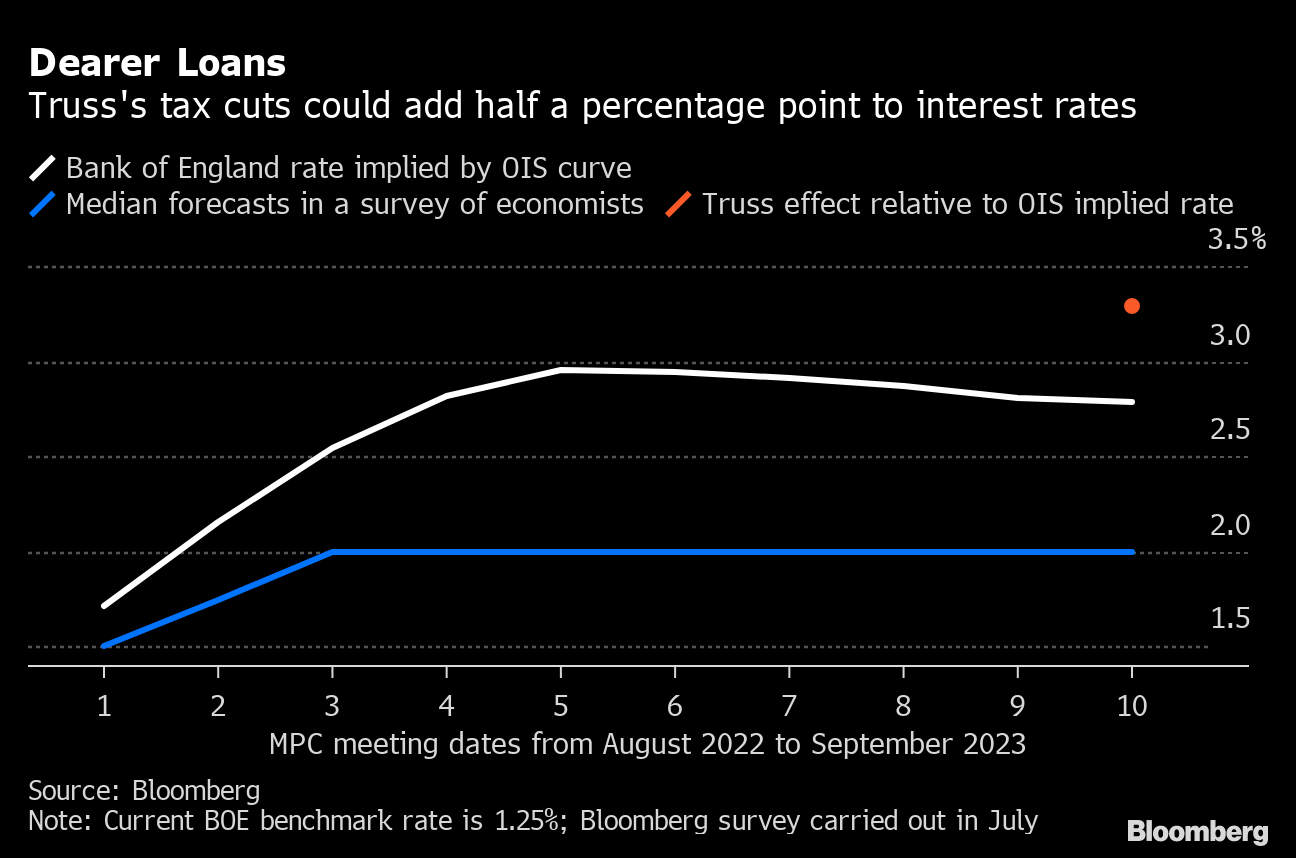

Liz Truss Tax Cuts May Push Interest Rates Closer To Uk S Pain Threshold Bloomberg

Carried Interest In Private Equity Calculations Top Examples Accounting

Kyrsten Sinema Donors Score Win From 14b Carried Interest Tax Break

17 Property Tax Return Tips Uk Self Assessment Youtube

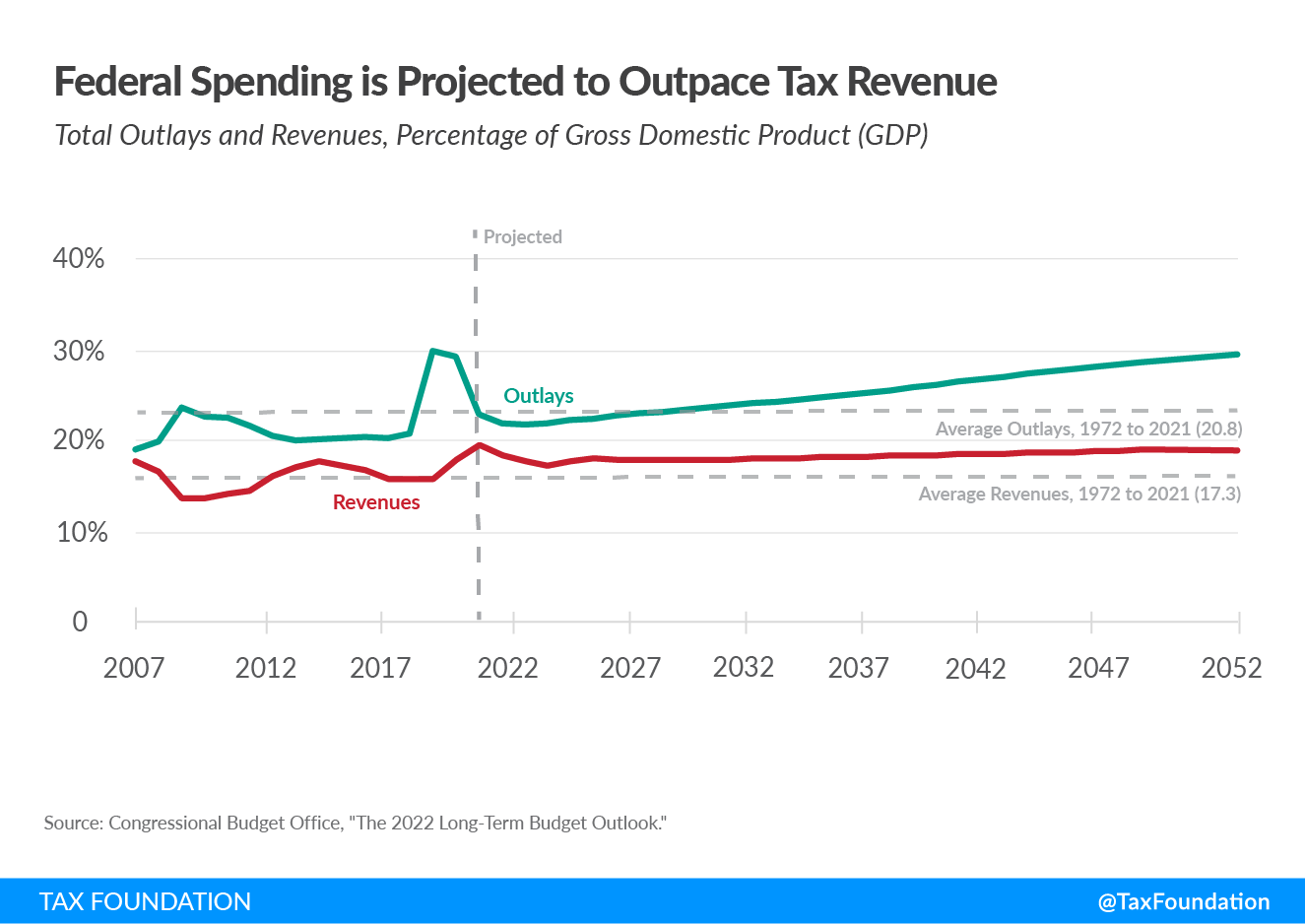

Cbo Long Term Budget Outlook Details Analysis Tax Foundation

Definitive Guide To Carried Interest Book Private Equity International

How Does Carried Interest Work Napkin Finance

How Does Carried Interest Work Napkin Finance

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

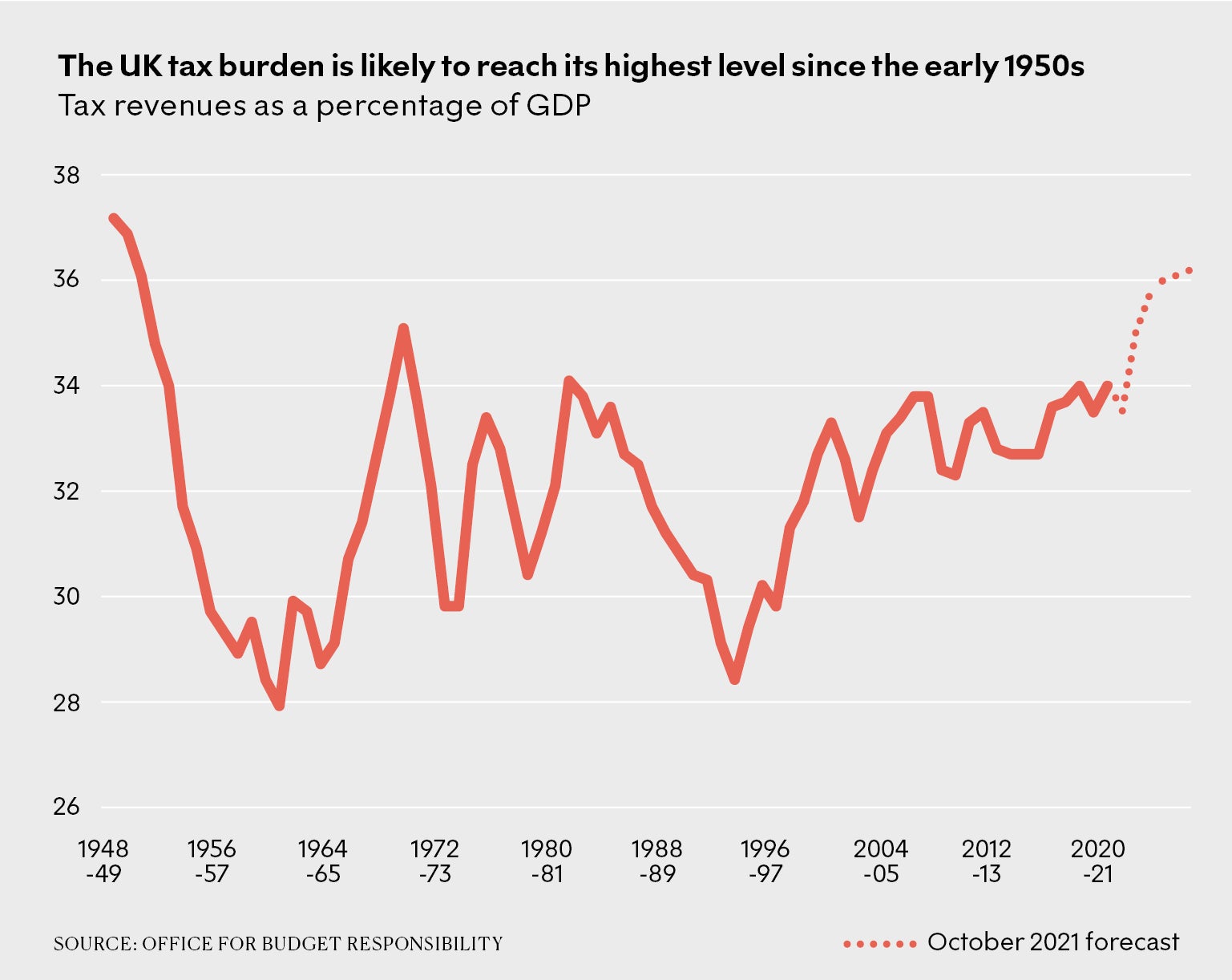

The Rise Of High Tax Britain New Statesman

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

How To Tax Capital Without Hurting Investment The Economist

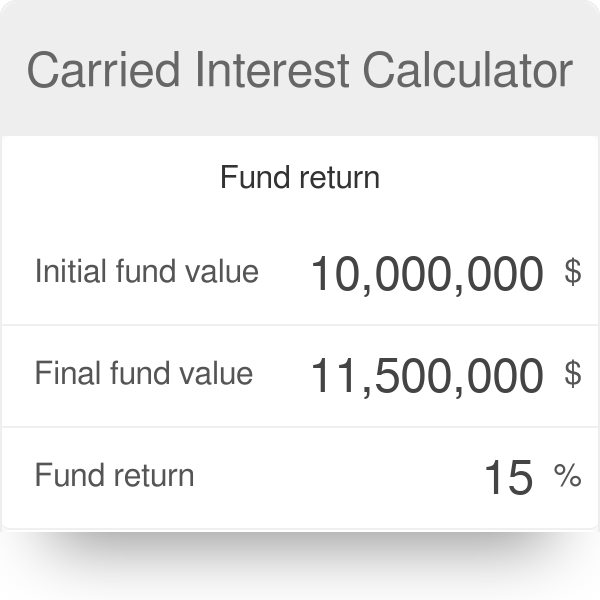

Carried Interest Calculator And Formula

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

How Private Equity Conquered The Tax Code The New York Times